As seen in

By Lesley Fair.

Tick. Tick. Tick. For small business owners, gig workers, and freelancers fighting for survival during the pandemic, every day that passed without essential capital put their futures at risk. So when Womply – also known as Oto Analytics, Inc. – and CEO Toby Scammell claimed to offer a “PPP Fast Lane” to get them speedy access to funds through the Paycheck Protection Program, it sounded like time was finally on their side. But according to a proposed FTC settlement, consumers got clocked by the defendants’ misleading claims that they could get people PPP loans and their false promise to process applications quickly. As part of the settlement, the defendants will pay $26 million in damages and are prohibited from making those types of misrepresentations in the future.

Under the Coronavirus Aid, Relief, and Economic Security Act – the CARES Act – eligible small businesses could get emergency loans under the Paycheck Protection Program run by the Small Business Administration. Operating on a first-come, first-served basis, the PPP was a time-sensitive program. When funds ran out in May 2021, the SBA stopped accepting new applications. So small businesses had to strike while the PPP iron was hot.

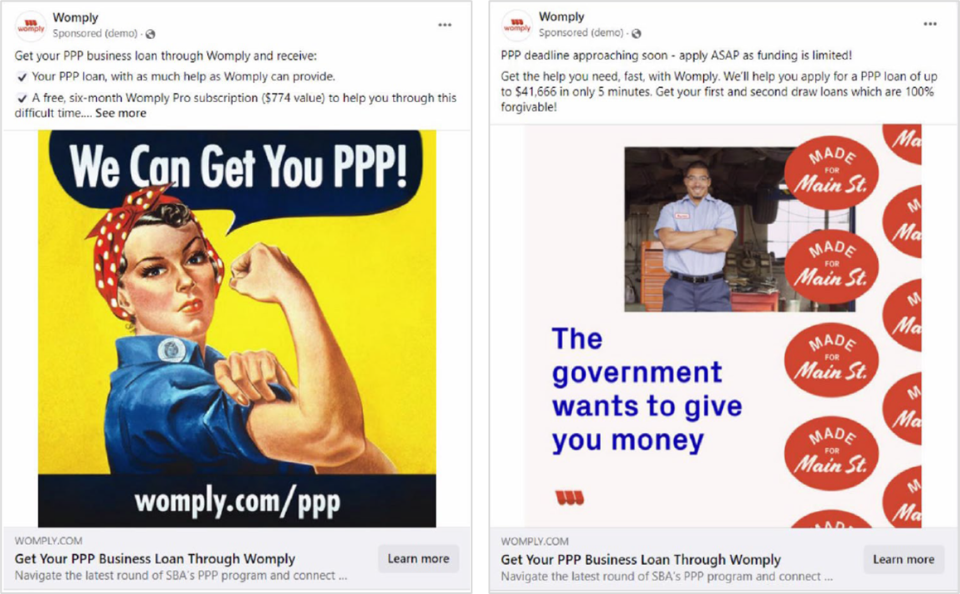

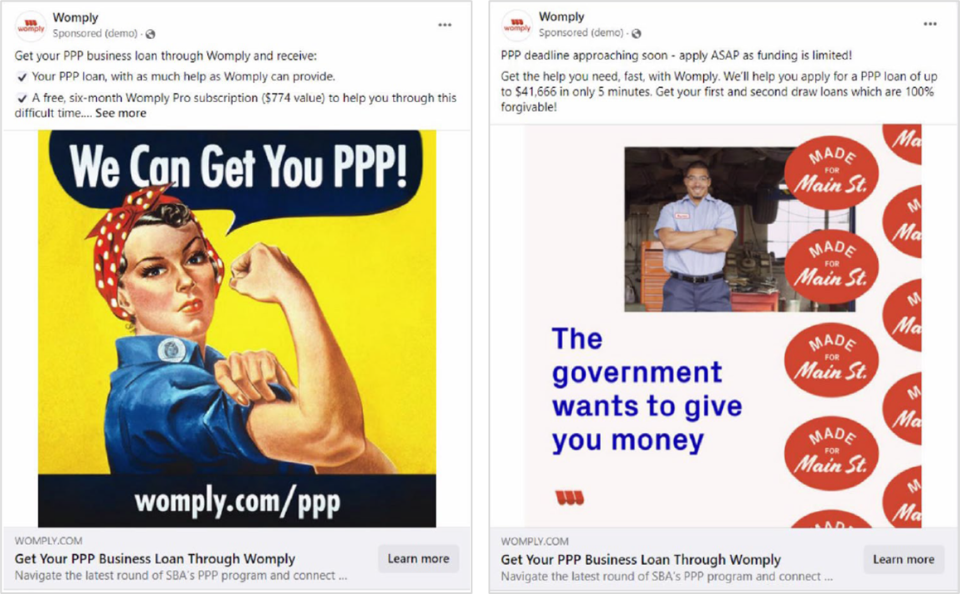

The FTC says the Womply defendants certainly struck while the marketing iron was hot, advertising via email and social media beginning in February 2021, including through referral partners like influencers and CPAs. For small businesses unfamiliar with the program’s particulars, the company’s invitation to “apply for your PPP business loan through Womply and receive . . . your PPP loan with as much help as Womply can provide” was likely to catch their eye – as was the headline “The government wants TO GIVE YOU MONEY.” Using the iconic Rosie the Riveter image, the company also told prospective applicants, “We Can Get You PPP!”

Womply’s ads highlighted the urgency message both in terms of the need for small businesses to act quickly and Womply’s ability to process applications “within 24 hours.” One social media promotion advised people to “apply ASAP as funding is limited! Get the help you need, fast, with Womply. We’ll help you apply for a PPP loan of up to $41,666 in only 5 minutes.” Once the defendants began accepting applications in March 2021, they continued to hammer home that message, telling consumers that “most applications are now processed in under 24 hrs” and that their review process would soon speed up “to just 3 hours.”

Through claims like that, the defendants lured millions of small business owners, gig workers, and freelancers to apply for PPP loans through the Womply platform. But according to the complaint, despite the defendants’ promises to get small business consumers PPP loans and to process their applications quickly, of the more than 3.25 million PPP loan applications people initiated on the Womply platform, the defendants failed to achieve funding for more than 1.99 million. Do the math and that means that Womply failed to get 61% of them what the company promised. The FTC says many of the businesses that didn’t get funding were eligible for PPP loans, but Womply’s failure to fix known technical problems with its platform or otherwise help process applications left those small business consumers broken down, steaming, and stranded in Womply’s so-called “Fast Lane.”

Womply’s customer support channels also proved useless for thousands of consumers. According to the FTC, “In late March 2021, after receiving more than 4,800 telephone calls that month to Womply’s customer service line and facing increasing requests by email that Defendants frequently did not resolve, Defendants entirely disconnected their telephonic customer service.” But despite clear indications that their claims were false or deceptive, the defendants allegedly doubled down by continuing to advertise they could get people PPP loans and process their applications quickly. The upshot for small businesses struggling to stay open? The FTC says Womply’s conduct resulted in many of them missing out on the PPP window and the funds they desperately needed.

The complaint alleges multiple violations of the FTC Act and the COVID-19 Consumer Protection Act. To settle the case, the defendants have agreed to pay $26 million in damages and are prohibited from making a broad range of misrepresentations related to the marketing of financial products or services. The FTC will use the $26 million as redress for small businesses harmed by the practices challenged in the complaint. Check the case page in the months ahead for announcements about redress payments.

The settlement with Womply suggests three messages for businesses.

Don’t promise services you can’t provide. Of course, companies must have appropriate substantiation to support their objective product claims, but customer service representations need proper proof, too. For example, promises about the speed with which your company will process applications or the availability of customer support are also subject to established truth-in-advertising standards. Hope and hype are insufficient.

If you find yourself in a hole, stop digging. So what should a company do if becomes clear it isn’t living up to its advertising claims? That’s the time to act quickly to formulate a truthful strategy that protects consumers. The worst possible approach is to keep repeating misleading representations.

Small business consumers, the FTC has your back. Quoting correspondence from Womply customers, the complaint describes the devastating impact the defendants’ conduct had on many small businesses at a time when they needed access to available help. The FTC has brought numerous cases involving deceptive B2B marketing and will continue to protect small business consumers and gig workers from illegal practices. For example, just a few weeks ago, the FTC amended the Telemarketing Sales Rule to cover misrepresentations made in B2B calls. Furthermore, in addition to the $26 million proposed settlement with Womply, the FTC’s just-announced $33 million proposed settlement with Biz2Credit addresses claims by another company that allegedly deceived small business consumers about PPP loans.