As seen in

By Aneeta Mathur-Ashton

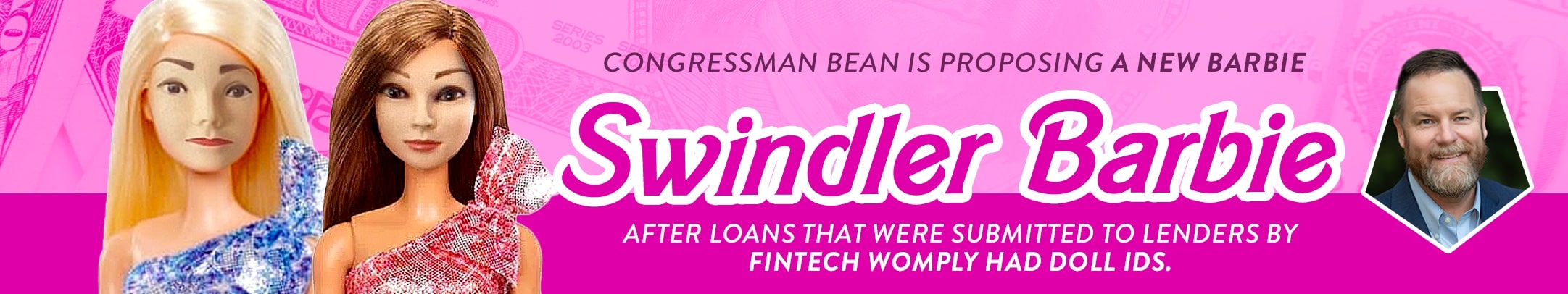

Barbie, Ken and wax figures…meet some of the fake personas at the heart of PPP scheme used to obtain fraudulent funds

Scammers created fake identities with pictures of doll faces and other figurines to rip off the nation’s largest COVID-19 relief program, according to images of the phony accounts that were given to government investigators and later obtained by The Messenger.

The doll-face scam, unreported until now, accounted for just a fraction of the estimated $80 billion in fraud that plagued the Paycheck Protection Program and that was the subject of a scathing House committee report accusing financial technology companies of facilitating the taxpayer ripoff.

Called “fintechs,” the companies billed themselves as computer-savvy middlemen who could help get government money from approved lenders into the hands of small businesses struggling after the pandemic hit in the spring of 2020. The fintechs claimed their artificial intelligence software would automatically check applicants’ picture IDs uploaded to PPP application portals.

But scores of scammers uploaded the doll faces instead. And they got money – no questions asked.

Two of the biggest fintechs in the program, Womply and Blueacorn, ended up facilitating one in every three PPP loans in 2021, according to the House report. The Small Business Administration, which oversaw the program, ultimately suspended them earlier this year. The SBA last week continued the suspension of Womply for another six months as it investigates what happened.

“I don’t know if we’ll ever know the extent of the fraud enabled by Womply, but many of the companies that worked with Womply said it was significant,” said Nick Schwellenbach, a senior investigator at the watchdog group Project On Government Oversight, who testified before the Senate Committee on Small Business and Entrepreneurship on the role that fintechs played in PPP fraud.

The fraudulent doll-face photos from Womply were given to SBA, which said it was not able to comment on any active or potential investigations. The Messenger obtained the images from a source familiar with the investigation. One lender who was tied up in litigation at one point with Womply said the fintech blamed a sub-vendor for approving the doll-face ID photos.

“We found doll heads and faces and all of that,” said the lender, who spoke on condition of anonymity to avoid bad publicity associated with the program. “But some of these got by because of the way the program was established, which was designed to get the money out the door.”

The lender said his firm regretted settling its litigation with Womply just before the scathing congressional report showed how much fraud allegedly was enabled by the fintechs.

Both fintechs have been involved with litigation involving a handful of lenders in the program. None would comment on the record. Solo Global Inc., the successor company to Womply, has also shuttered operations and is no longer available for comment. Womply’s CEO Toby Scammell also did not respond to requests for comment.

Convicted in 2014 of insider trading and banned from securities trading, Scammell resisted “providing information to federal investigators conducting PPP fraud investigations,” according to a 130-page report released by the House Select Subcommittee on the Coronavirus Crisis in December after an 18-month investigation into the role of fintechs.

Womply’s most lucrative program ended up being its streamlined approach known as Fastlane, which earned more than $2 billion in fees, according to a Washington Post article. But despite its promises and a wide net of lenders, congressional investigators found that Womply was one of two companies that enabled the majority of PPP fraud, processing over $5 million in loans for itself.

Fraud was always a known risk of the program because the White House and Congress designed it to quickly flood the economy with cash and keep businesses afloat.

“Womply’s partner lenders had some of the highest rates of suspicious loans in our study, and a Congressional investigation into PPP fraud indicated that they had very poor due diligence for detecting fraud,” said Samuel Kruger, an assistant professor of finance at the University of Texas at Austin.

Kruger and his colleagues authored a study in 2021 detailing the fraud these fintechs created.

“There were billions of dollars of fraud in the PPP program and Womply played a large role in facilitating this fraud,” he added.

One of Womply’s lenders, Benworth Capital, said it used the SBA’s endorsement as support for getting into business with the firm, according to the Miami Herald, which first reported that an agency official left his government post and ultimately was paid by Womply to be an expert in arbitration against one of the lenders in the program, Benworth Capital.

Both Benworth and another lender, Fountainhead, discovered problems with Womply’s identity verification software, according to a source familiar with the congressional and SBA investigation who spoke on condition of anonymity to share confidential information. The source said that Womply claimed to use automated systems with AI to scan and verify the faces of applicants against submitted driver’s licenses or a passport.

But, the source said, the lending firms discovered the system could be easily defeated by images of mannequins or by taking someone’s ID photo from the internet and pasting it on a doll.

The constant flagging in real time and lack of action proved to be too much and Benworth ended up severing ties with Womply on May 7, 2021, after roughly six weeks of working together. But by then, it was too late.

As arbitration with Benworth dragged on, Womply wrote a letter to the SBA that accused the Florida-based lender of using its political clout “to leverage his relationship with Senator Marco Rubio of Florida to convince the SBA to issue new rules that would help Benworth in its private commercial dispute with Womply.”

Rubio was a chief architect of the PPP program in the Senate. But he has had no involvement in the arbitration, according to a spokesman who said “there is no truth to those allegations” by Womply. Benworth called the allegations untrue and, in a written statement, said it was limited in discussing the matter because “ongoing litigation makes it difficult for us to comment.”

“We support the findings of Congressional investigators whose report raised serious questions concerning significant improper conduct from a few bad actors connected to the PPP program,” the Benworth statement said. “We are hopeful that any individuals who acted improperly will be held accountable.”

Staff writer Marc Caputo contributed to this story

Read more at: https://themessenger.com/politics/swindlers-used-barbie-dolls-to-rob-covid-relief-program