As seen in

By Aneeta Mathur-Ashton

SBA’s Inspector General Hannibal Ware also confirmed some members of the fintechs have been arrested

The Small Business Administration on Thursday confirmed it has opened an investigation into the five financial technology companies that were the subject of a scathing House committee report accusing them of enabling COVID relief fraud.

The agency’s inspector general, Hannibal “Mike” Ware, on Thursday confirmed the investigation during testimony before a House committee reviewing SBA and OIG’s reports of fraud in the program. But Ware shied away from offering details, saying “I cannot speak to the ongoing investigation.”

One of the companies charged is Womply, the subject of an exclusive report by The Messenger detailing how scammers created fake identities with pictures of doll faces and other figurines to rip off the Paycheck Protection Program, the nation’s largest COVID-19 relief program.

Womply acted as a middleman, offering artificial intelligence software it said could help quickly get money to businesses in need by checking applicants’ pictures uploaded as part of their aid applications. But that software, and similar AI programs used by other fintechs, failed to detect fraudulent images of doll faces and other figurines.

When asked by Rep. Dan Meuser, R-Pa., at Thursday’s hearing if arrests have been made in connection to the investigation, Ware said the arrests that have already been made are public.

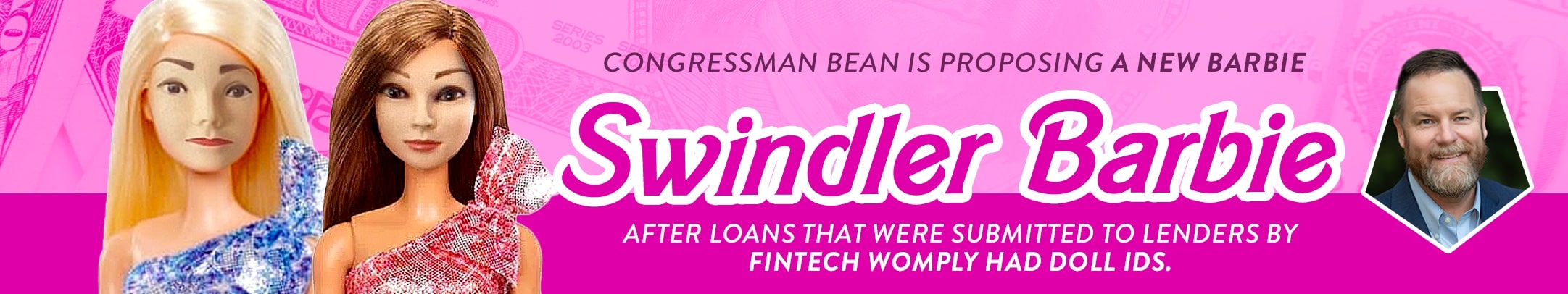

Rep. Aaron Bean, R-Fla., used the exclusive reporting from The Messenger as evidence, saying, “One of America’s favorite dolls is Barbie. We love Barbie… but it seems con men have hijacked Barbie and I present to you swindler Barbie.”

The SBA told The Messenger it cannot comment on any ongoing investigations at this time.

Nick Schwellenbach, a senior investigator at the watchdog group Project On Government Oversight who testified before the Senate Committee on Small Business and Entrepreneurship on the fintech’s role in the fraud, told The Messenger the news is a long overdue development.

Schwellenbach said the investigation “underscores how seriously deficient these firms were in performing basic due diligence that could have prevented wide scale fraud and how dismissive their corporate leaders were in addressing those concerns.”

“They put profits ahead of ensuring these dollars went to those who truly needed them.”

Another person familiar with the matter told The Messenger said of the announcement, “It’s about time.”

“If they [SBA] want to do anything about this, they need to be quicker. They need to be more transparent and need to communicate with the public because it’s the public’s money.”

The source added that the investigation into Womply and Blueacorn, another fintech, needs to be criminal.

“They have to get them all…That’s the only way. They really do and they can’t forget about any of these people and the public deserves to be updated on this.”

Womply, one of the biggest fintechs in the program, ended up facilitating one in every three PPP loans in 2021, according to the House report. Despite earning more than $2 billion in fees, congressional investigators found that it was one of two companies that enabled the majority of the fraud.

Its CEO Toby Scammel, who was convicted in 2014 of insider trading and banned from securities trading, was unavailable for comment. Scammell has now bought a website called 21 Hats and is using it to criticize both Congress and the SBA on the rampant fraud in the program.