As seen in

Major Fraud

The May 4 story “Top SBA official oversaw PPP, then did work for one of its worst offenders” is a dismaying account of how a former high-ranking US Small Business Administration official, who was in charge of policing the much-needed program, left to work for the largest fraudster in the Paycheck Protection Program boondoggle.

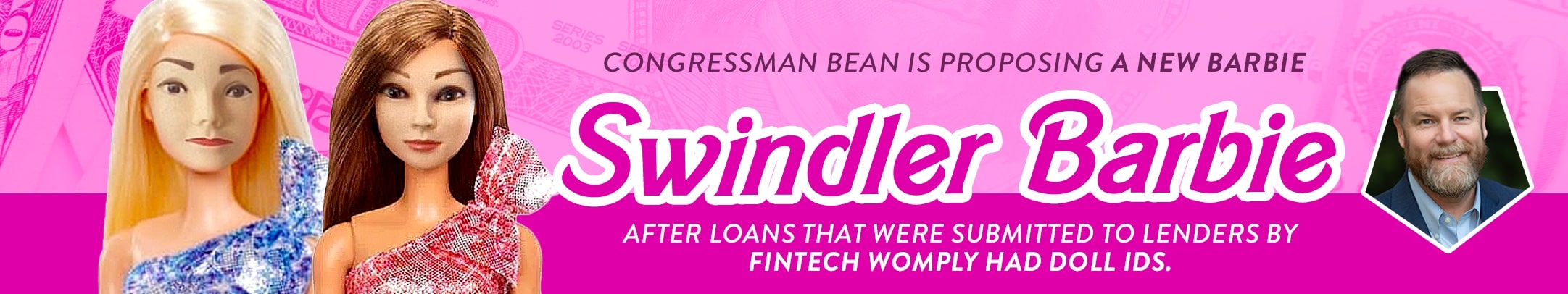

In December 2022, the House Select Subcommittee on the Coronavirus Crisis issued a report detailing how two companies – Blueacorn and Womply – committed widespread PPP fraud. The McClatchy article includes a video showing the Blueacorn CEO bragging with a wad of cash after receiving over $1 billion in taxpayer money in fees to administer the PPP. Meanwhile, the vast majority of Womply’s $2 bill revenue in 2021 came from fees collected from PPP lenders for referring applications through its platform.

How is it, then, that former SBA Chief of Staff William Manger, who was responsible for the development, implementation, and execution of the PPP program, was able to successively work for Womply?

Our country has laws designed to prohibit these cozy relationships and improprieties. I surely hope Manger’s transgression is an isolated incident that doesn’t tarnish the reputations of the dedicated professionals who labored in establishing our country’s response to the global pandemic. I implore the SBA leadership to put guardrails in place to handle the distribution of aid against graft and cronyism. If we do not learn from this incident, corruption will continue to spread.