As seen in

Congress should hold off on SBA program expansion

Congress is currently examining the expansion of the Small Business Administration’s lending programs. Expansion makes sense for a variety of reasons, but there should be no expansion until the historic fraud and abuse witnessed in the Paycheck Protection Program is investigated and resolved.

By connecting them with lenders, capital and counsel, the SBA serves a vital role for the health of America’s small business community. Congress’s role is to provide constant oversight and ensure that SBA remains accountable and responsive to the taxpayers who fund its mission.

In recent years, the SBA has begun acting unilaterally, ignoring the advice and counsel of the U.S. Department of Treasury, Office of the Inspector General and other related agencies in ways that have backfired and turned the SBA into a net negative for taxpayers and small businesses. The fallout of the COVID-19 pandemic laid this truth bare for all those who were paying attention to see.

When I served as Treasurer of the United States, the U.S. government spent just $1 trillion annually to keep the government functioning; however, the government spent $5.8 trillion on COVID relief alone — much of which was lost to fraud — in large part due to the SBA’s failure to listen to the OIG.

The SBA approved over 10 million loans totaling $780 billion under the Paycheck Protection Program, nearly $200 billion on the Economic Injury Disaster Loan Program, $28 billion on the Restaurant Revitalization Program and more than $10 billion to Community Development Financial Institutions.

The problem didn’t lie in the existence of these lending programs, small businesses required and deserved relief from the government-mandated economic shutdowns. The problem lied in the billions upon billions of these taxpayer dollars that went to waste because the agency refused to follow the OIG’s guidance.

In December 2020, after carefully analyzing the SBA’s COVID-19 lending programs, the OIG provided key recommendations to reduce the amount of fraud and uses and abuses of the system, which included advising SBA to collaborate more directly with the Treasury Department while implementing tighter internal controls. However, the SBA dismissed many of these recommendations and continued allowing its COVID relief fund vetting partners to operate quickly and loosely — unbecoming behavior for an official agency of the U.S. federal government.

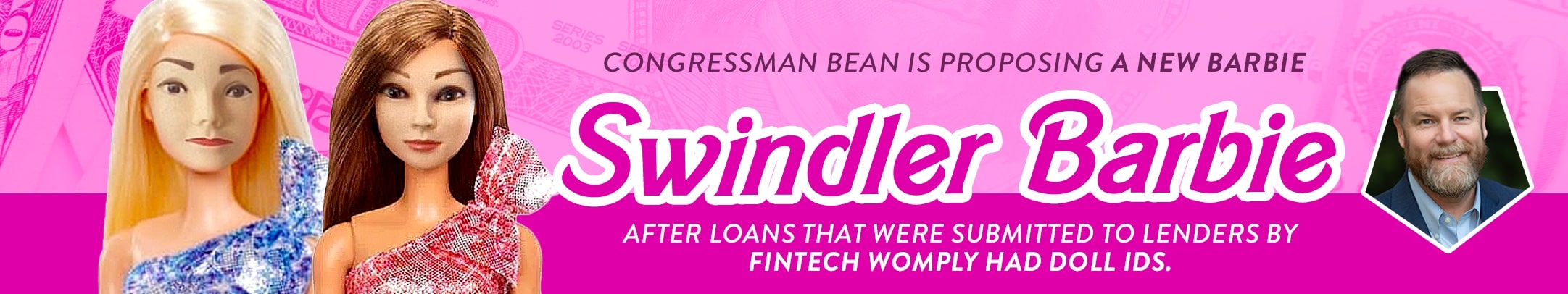

So it shouldn’t come as a surprise that, last December, the House Oversight Committee released a report detailing that close to 20% of the SBA’s Covid-19 Economic Disaster Loan Program funds went straight into fraudsters’ pockets. Their report found that Womply and Blueacorn, two fintech companies responsible involved with almost 33% of every PPP loan in 2021, did next to nothing to stop these uses and abuses of the system.

They had no reason to — the government paid them for the number of loans they wrote, irrespective of their quality. And since the SBA refused to responsibly oversee the fintech’s operations or protect the lenders who had to act on their advice, Womply, Blueacorn and the like had no incentive to vet these loan applications rigorously. The less selective these two companies were, the more money from the federal government they would receive.

According to the House Oversight Committee’s report, Blueacorn had maintained just “one direct employee who assisted with processing PPP loan applications” despite receiving over $1 billion in processing fees, while Womply’s lending partners accused the company of allowing PPP to become subject to “rampant fraud.” If only the SBA acted on the OIG’s December 2020 quality control guidance, these fintechs wouldn’t have been able to escape their oversight and accountability responsibilities to the extent that they did.

And yet, since the release of this damning report, the SBA has done little to signal regret for its behavior or demonstrate a better understanding of the need to work more effectively with OIG and Treasury moving forward. In fact, it’s done much the opposite. It recently chose not to pursue repayment on any defaulted PPP and EIDL loans worth less than $100,000 (which struck the House Small Business Committee’s ire) and has appeared to do little to recover the more than $100 billion in fraudulent and improper loans made through COVID-19 relief programs. Talk about a slap in the face to taxpayers.

For years, the SBA was one of small businesses’ and good government groups’ favorite agencies in Washington, but now — as it continues to let fraudsters off the hook and look the other way when OIG and Treasury make recommendations — it’s inadvertently creating new opportunities for big businesses to gain unfair advantages over their smaller competitors.

When the SBA operates effectively, the U.S. economy is without question better with the agency in it. Today, Congress needs to put the brakes on the SBA expansion, but tomorrow, it must do everything in its power to restore the agency to its former glory.

Bay Buchanan served as the 37thTreasurer of the United States.